An adjustable-rate mortgage (ARM) is the type of house loan where the interest rate changes. If you get this loan, the interest rates will change regularly, like once a month or a year, after initially remaining constant for a brief period.

It can help you save money early by providing a lower initial rate, especially in light of recent rate rises. It's crucial to remember that both the rate and your monthly payment could increase after the first period.

The starting interest rate on it is usually known as a teaser rate. It is a standard adjustable-rate mortgage (ARM) and a risky teaser loan that offers you a meager rate upfront but could have a significant increase later on.

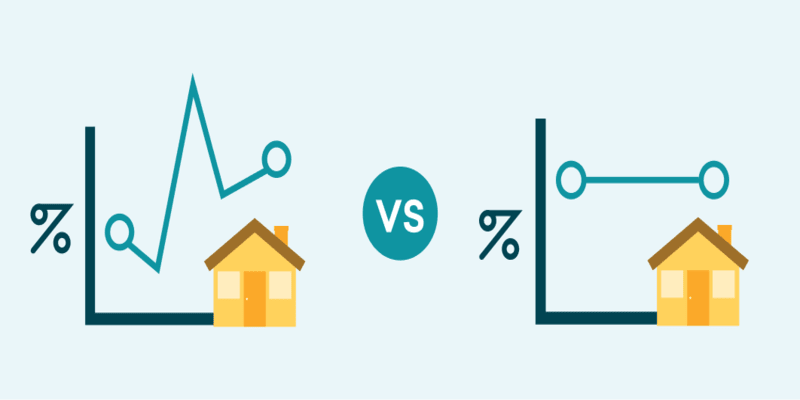

Two types of mortgages (ARM) are fixed-rate and adjustable-rate mortgages, which are slightly different, although they are frequently the same. Are you still confused about what an Adjustable-Rate Mortgage? Then, keep scrolling and read this article completely.

What are ARM Rate Caps?

Rate limitations on adjustable mortgages (ARMs) protect you from probable significant annual increases in monthly payments. These ceilings restrict the amount at which rates and payments can fluctuate.

- A periodic rate cap sets a cap on the amount that the interest rate may change annually.

- A lifetime rate cap restricts the interest amount that may increase during the loan's term.

- A payment cap limits the amount in dollars the monthly payment can increase for the loan, as opposed to the percentage points that the rate can fluctuate.

What Is The Process Of An Adjustable-Rate Mortgage?

ARMs consist of the following stages:

Fixed period

This term has a low initial (and fixed) rate, which lasts for three to 10 years. It usually depends on the loan. It is the first digit in an ARM naming scheme, such as the "7" in "7/1".

Modifiable duration

The flexible period will start when the fixed period ends and continue until the loan is repaid, sold, or refinanced.

Adjustment rate

The "6" in "5/6" and the "1" in "7/1" represent the number of times ARMs are adjusted, which can be done either annually or every six months.

Types of Adjustable-Rate Mortgage (ARMs)

ARMs are generally 30-year mortgages, but the length of the fixed rate phase and the frequency of rate changes after the variable-rate period begins can extend significantly. The following are the most common loan terms:

Hybrid ARM

Standard adjustable-rate mortgages are hybrid versions. After a few years, often three to ten, the loan's interest rate is fixed and changes on a fixed timetable, like once a year.

Payment-option ARM

Borrowers can choose their payment schedule and structure with an adjustable-rate mortgage (ARM), such as interest-only, a period of 15, 30, or 40 years, or any other payment equal to or higher than the minimum payment.

The first payment is based on the original loan rate and a standard 30-year amortization. However, if you have an ARM payment option, you may experience a reduction.

which means that you aren't making enough payments to cover your interest, which causes your loan balance to rise even more.

Your lender may modify the loan and demand substantially larger, maybe unaffordable, payments if the sum increases too much.

Interest-only ARM

Interest-only adjustable-rate mortgages, or ARMs, have a fixed time when the borrower only pays interest, not principal. The borrower pays principal and interest in full after the interest-only period expires.

The interest-only period could be several months or several years. Since the payments are simple interest during that time,

The borrower will only collect equity in their house once its value increases. However, the monthly payments will be minimal throughout that time.

Pros and Cons of Adjustable-Rate Mortgages (ARMs)

It is essential to consider the advantages and disadvantages of ARMs. Here are some prominent adjustable-rate mortgage pros and cons.

Pros

- You had reduced your monthly payments at first, and your initial interest rate will be lowered, which results in smaller monthly payments and the opportunity to give more money to the principal.

- If your monthly payment is initially smaller, you can pay more when you have extra money and less when you need it for other expenses.

Cons

- Even with the maximum set, your interest rate and monthly payments could increase to a troublesome level.

- This kind of mortgage has a more complex structure than a fixed-rate mortgage, which may require more work.

Should You Choose a Mortgage with an Adjustable Rate?

Undoubtedly, an adjustable-rate mortgage has much to offer, including the possibility of instant savings and lower monthly payments.

But this option only benefits you if you want to leave your home briefly. If not, then it might cause an issue for you. Because your interest payment rate will increase a lot,

You will find it difficult to pay it back at once. So, even if you are considering getting a new house for yourself, consider the terms of ARM again and again to determine whether it is the right option.

If you still need clarification about how to get it done, then you can use the adjustable rate mortgage calculator on Bankrate, which will help you determine if it's the best financing option for you.

Conclusion

In summary, Adjustable-Rate mortgages (ARMs) have lower beginning interest rates and are more affordable and beneficial for you at first.

But you should be more cautious, though, as interest rates are subject to change and could result in higher monthly payments.

Moreover, when selecting an ARM, consider personal preferences and financial circumstances. So, now there is no need to be confused about what is a fixed-rate mortgage anymore because this article will help you solve your related queries.